In today’s complex regulatory environment, leveraging compliance technology is essential for organisations to keep pace with evolving mandates and to enhance operational efficiency.

One of the most critical benefits companies are embracing is how regulatory reporting made easier for advisors transforms the compliance landscape by reducing manual efforts and improving accuracy, enabling better focus on strategic objectives.

The Evolution of Compliance Technology

Compliance technology evolved from simply tracking systems into platforms that use artificial intelligence, analyse data, automate tasks to manage risk and meet regulatory requirements while keeping an auditable trail of all compliance activities.

Businesses move to compliance functions that are more agile and use data.

This enables them to comply with regulations more efficiently and effectively.

Industry experts note that centralised compliance systems are needed in order that organisations can manage multiple regulations within a single compliance ecosystem.

This complies in a more streamlined way and can adapt to regulatory changes.

Key Benefits of Modern Compliance Solutions

Automation for Efficiency

Automating compliance-related tasks saves time, saves human resources, tracks progress automatically, compiles statistics automatically, and alerts users about changes in compliance requirements.

Repeated tasks such as logging compliance activities and generating reports can be expedited.

This allows compliance teams to dedicate more time to identifying risks to reduce at more of a planned level instead of at an administrative level.

Enhanced Accuracy and Transparency

Where there are strong compliance technologies in place, an audit trail is created both for regulatory audits and for internal audits.

When a firm is more open and transparent, it can prove its compliance more.

Compliance officers can monitor the risk and compliance status across the organisation when they use real-time dashboards.

Predictive Risk Management

Artificial intelligence-powered compliance tools are now used for the detection of patterns and anomalies, enabling companies to adopt a preventative approach to compliance issues.

This improves risk prevention and organisational resilience, with the likelihood of a breach being reduced through early identification of a vulnerability.

Making Regulatory Reporting Easier for Advisors

Increasingly, technology is enabling advisors to meet their regulatory reporting requirements in an efficient manner via user-friendly applications that automate the collation of information and are compliant with jurisdictional regulations.

Advisors can focus less time on documentation for compliance purposes and more time on servicing their clients and making decisions about the direction their business is headed, creating a compliance process that supports efficiency and better client relationships.

Collaboration and Integration

Modern compliance is no longer siloed.

Teams collaborate cross-functionally through unified cross-team compliance platforms.

It enables the breaking down of silos among the legal, risk, compliance, and audit functions; also, when integrated with workflow management, it is possible to track and resolve compliance incidents with clearly articulated accountability.

Through integration with existing business systems, data discrepancies are eliminated because compliance tech interacts directly with finance, HR, and other business applications to create a single source of truth within the organisation, which makes compliance easier to manage and improves data governance.

Security and Data Privacy as Cornerstones

Other compliance tech products utilise encryption.

They utilise multi-factor authentication.

They utilise secure data storage.

This protects data against unwanted access and malicious cyber threats.

It follows data privacy rules.

It creates trust with clients and stakeholders.

Implementing Compliance Technology: Best Practices

For successful adoption of compliance technology, organisations should:

- Assess Regulatory Requirements and Internal Needs: Understand the specific mandates that apply and identify manual or high-risk processes that could benefit from automation.

- Choose Scalable Solutions: Select technology platforms that can evolve with regulatory changes and growing business complexity.

- Train and Engage Teams: Equip compliance and advisory teams with knowledge and resources to utilise technology effectively.

- Ensure Seamless Integration: Connect compliance tools to existing systems for streamlined data flow and consistency.

- Focus on Continuous Improvement: Regularly review and update compliance strategies, leveraging insights gained from technology analytics.

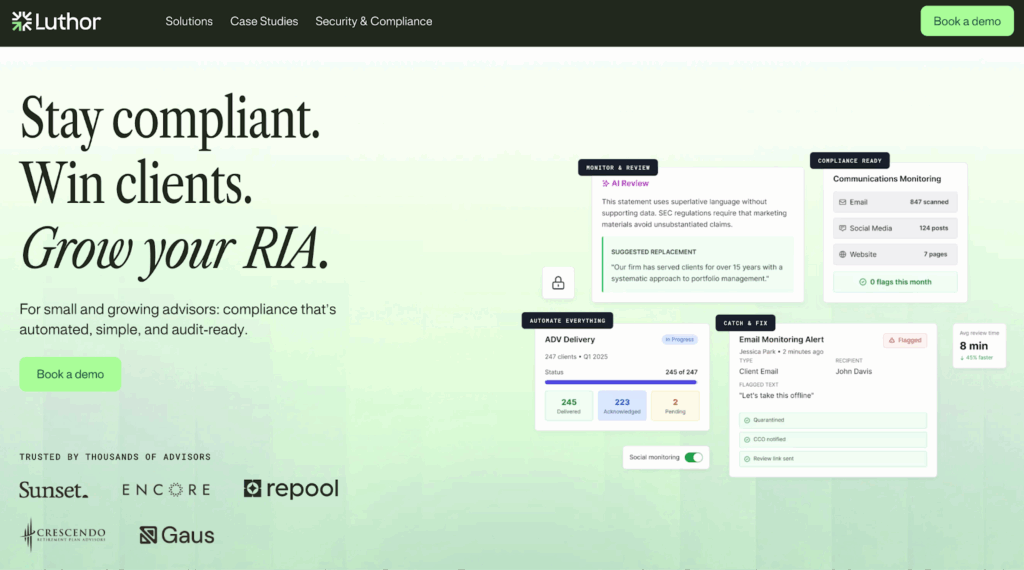

The Role of Innovative Platforms Like Luthor.ai

The next generation of compliance solutions, such as Luthor.ai will involve the use of artificial intelligence and machine learning to improve compliance and reporting, automate complex judgments about the meaning of rules, and even enable smarter decisions to create a better compliance experience, which is more efficient, accurate, and transparent.

Conclusion

This compliance technology has become a planned enabler by automating repetitive tasks, providing predictive perceptions, and alleviating the burden of regulatory reporting, made easier for advisors, setting the stage for companies to better navigate complex regulatory environments.

Advisors and compliance professionals can concentrate on business value and stakeholder trust through tool use.

Organizations that invest in integrated, scalable, and smart compliance solutions prepare better in an evolving regulatory environment.

The environment prioritizes planned agility and future-readiness.