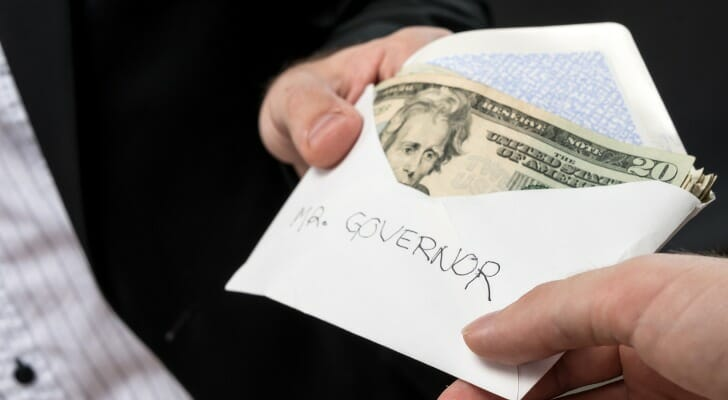

When you donate to a political party, you may be able to get tax deductions. This is because the Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

If you’re not sure whether a political party is a qualified charitable organization, you can check the IRS website or ask the party itself.When you make a donation to a political party, you’ll need to keep records of the donation. This includes the date of the donation, the amount of the donation, and the name and address of the political party.

Are political donations tax deductible

Yes, political donations are tax deductible if they are made to a qualified charitable organization. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

Can I deduct my political donations on my taxes

Yes, you can deduct your political donations on your taxes if they are made to a qualified charitable organization. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

What is the tax deduction for political donations

The tax deduction for political donations is the same as the tax deduction for any other charitable contribution. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

How much can I deduct for political donations

You can deduct up to 50% of your adjusted gross income for political donations. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

What is the difference between a political contribution and a campaign expenditure

A political contribution is a donation to a political party or candidate. A campaign expenditure is money spent on behalf of a political party or candidate. Campaign expenditures are not tax deductible.

What is the deadline to claim a deduction for political donations

The deadline to claim a deduction for political donations is the same as the deadline for any other charitable contribution. For most people, this is April 15th. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.

How do I know if a political party is a qualified charitable organization

The best way to know if a political party is a qualified charitable organization is to check the IRS website or ask the party itself. The Internal Revenue Service (IRS) considers political donations to be charitable contributions.To get the deduction, you’ll need to itemize your deductions on your tax return. And, you’ll need to make sure that the political party you’re donating to is a qualified charitable organization.